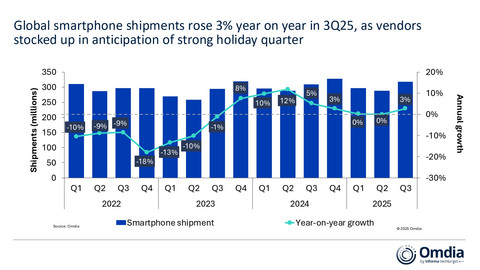

Global smartphone shipments rose 3% year on year in 3Q25, as vendors stocked up in anticipation of strong holiday quarter

The latest research from Omdia (https://omdia.tech.informa.com/advance-your-business/consumer-electronics-and-pro-av/smartphone-horizon-service) reveals that the global smartphone market grew 3% year on year in 3Q25, signaling a return to growth momentum driven by major product launches during the quarter. The rebound was boosted by strong replacement demand as well as several vendors preparing inventories across the channel ahead of a hectic 4Q25. Samsung maintained the position for the third consecutive quarter with a 19% market share, supported by sustained volume strength of its Galaxy A series alongside an upgraded 7th generation foldable portfolio. Apple grew iPhone shipments by 4% achieving its strongest Q3 performance ever, as early demand for the iPhone 17 series helped it secure 18% share. Xiaomi delivered another steady quarter with 14% market share, while TRANSSION and vivo each captured 9% share, rounding out the top five vendors for the quarter.

“Recovering consumer demand to both upgrade and replace smartphones is boosting the market following a disruptive start to the year, as reflected by all of the top five vendors growing compared to 3Q24” said Le Xuan Chiew, Research Manager at Omdia (https://omdia.tech.informa.com/authors/le-xuan-chiew). “The reception to the industry’s biggest launch events have been positive as the leading vendors balanced their focus between hardware and software. This season’s hardware standouts - foldables, slim phones, bold colors, and back-cover displays - have captured people’s attention. Compared to previous quarters, several vendors have increased their production targets as the initial demand delivered beyond expectations.”

“Many vendors used the muted 1H25 to calibrate inventories, streamline operations, and strategically optimize launch cycles, and are now benefitting from reigniting consumer demand,” added Chiew. “TRANSSION was a particular stand-out, growing by double digits compared to 3Q24 to its highest 3Q volume ever. This growth was supported by prudent inventory management earlier in the year, recovering demand in Middle East and Africa and refreshed model series such as Infinix’s Hot 60 and Smart 10 series.”

“Still, economic fears and uncertainty continue to weigh on vendors’ strategic planning, with many having to carefully balance volume scale, profitability, and revenue targets. Vendors remain cautious amid looming headwinds, but success in the short term will depend on identifying clearly defined opportunities with effective go-to-market and marketing strategies.”

“Competitive pressures in the current market are intense, and many vendors are experiencing significant strain on profitability,” said Runar Bjørhovde, Senior Analyst at Omdia (https://omdia.tech.informa.com/authors/runar-bjorhovde). “Rising bill-of-materials (BoM) costs, for example, are tightening the balance between competitive pricing versus margins. Semiconductors including storage and memory are under heavy pressure as smartphone vendors compete for production capacity amid the hypergrowth of datacenters and AI investments.”

“The challenge of implementing will be especially acute in emerging markets, where entry-level devices dominate. Here, avoiding price wars through offering financing options can make operational models more sustainable while keeping devices accessible to consumers - for whom smartphones make a transformative difference.”

To view the table, please visit https://www.businesswire.com/news/home/20251014961494/en/

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251014961494/en/

출처: Omdia

언론연락처: Omdia Fasiha Khan

이 뉴스는 기업·기관·단체가 뉴스와이어를 통해 배포한 보도자료입니다.